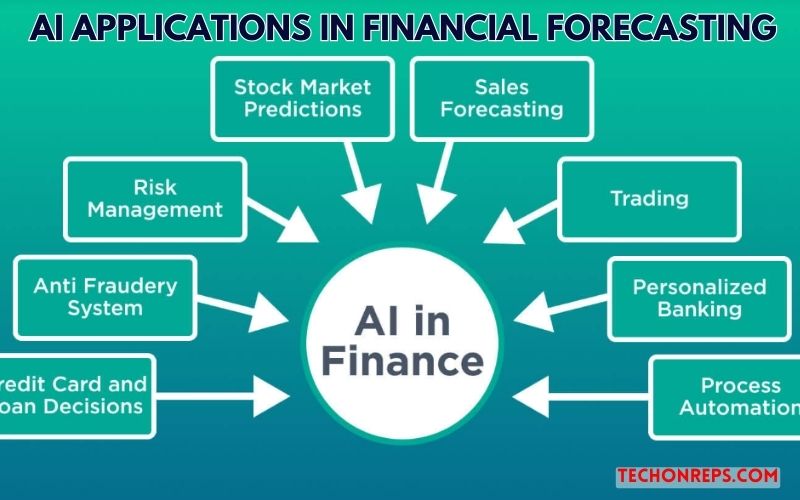

AI Applications in Financial Forecasting: Maximizing Accuracy

In recent years, artificial intelligence (AI) has revolutionized the financial industry, particularly in the realm of forecasting. With its ability to analyze vast amounts of data and identify patterns that humans might miss, AI has become an indispensable tool for financial institutions seeking to maximize accuracy in their forecasts. In this blog post, we will explore AI applications in financial forecasting and how they are helping organizations make more informed decisions.

1. Sentiment Analysis

Sentiment analysis is a powerful AI application in financial forecasting, particularly in the realm of stock market prediction. By analyzing news articles, social media posts, and other sources of information, AI algorithms can gauge the overall sentiment surrounding a particular stock or market. This information can then be used to make more accurate predictions about future price movements.

For example, if a large number of news articles are reporting positively about a certain company, AI algorithms might predict that the stock price will rise in the near future. Conversely, if the sentiment is negative, the algorithms might predict a decline. By incorporating sentiment analysis into their forecasting models, financial institutions can gain valuable insights into market trends and make more informed investment decisions.

2. Algorithmic Trading

Another key application of AI in financial forecasting is algorithmic trading. AI algorithms can analyze market data in real-time and execute trades at incredibly high speeds, far surpassing the capabilities of human traders. This allows financial institutions to take advantage of even the smallest market fluctuations and maximize their profits.

Furthermore, AI algorithms can also learn from past trades and continuously improve their strategies over time. This adaptability is crucial in the fast-paced world of financial markets, where conditions can change rapidly. By leveraging AI for algorithmic trading, financial institutions can stay ahead of the curve and maintain a competitive edge.

3. Risk Management

Risk management is another area where AI is making a significant impact in financial forecasting. AI algorithms can analyze vast amounts of data to identify potential risks and mitigate them before they become a problem. For example, AI algorithms can analyze customer data to identify individuals who are at high risk of defaulting on a loan, allowing financial institutions to take proactive measures to minimize their exposure.

Furthermore, AI can also help financial institutions manage their investment portfolios more effectively. By analyzing market trends and identifying potential risks, AI algorithms can help institutions diversify their portfolios and minimize the impact of market downturns.

4. Fraud Detection

AI is also being used in financial forecasting to detect and prevent fraud. By analyzing transaction data in real-time, AI algorithms can identify suspicious patterns that may indicate fraudulent activity. For example, if a credit card is used to make a purchase in a location that is far from the cardholder’s home, the AI algorithm might flag the transaction as potentially fraudulent.

By leveraging AI for fraud detection, financial institutions can protect themselves and their customers from financial losses. Furthermore, by identifying and stopping fraudulent activity early, AI algorithms can help prevent further damage from occurring.

5. Customer Segmentation and Personalization

AI is helping financial institutions better understand their customers by segmenting them based on various criteria such as demographics, behavior, and preferences. This segmentation allows institutions to personalize their offerings and provide tailored services to each customer segment, ultimately improving customer satisfaction and loyalty.

6. Credit Scoring

AI algorithms are being used to improve credit scoring models by analyzing a wider range of data points than traditional models. This includes not just credit history but also factors such as social media behavior, spending patterns, and even smartphone usage. This more comprehensive approach to credit scoring can result in more accurate assessments of creditworthiness and better lending decisions.

7. Forecasting Market Trends

AI is also being used to forecast broader market trends, such as economic indicators, industry performance, and global events. By analyzing vast amounts of data from various sources, AI algorithms can identify patterns and trends that may not be apparent to human analysts. This information can then be used to make more accurate predictions about future market movements, helping financial institutions make better investment decisions.

8. Compliance and Regulatory Reporting

AI is helping financial institutions comply with increasingly complex regulations by automating compliance processes and streamlining regulatory reporting. AI algorithms can analyze large volumes of data to ensure that transactions comply with regulations and flag any potential issues for further investigation. This not only reduces the risk of non-compliance but also saves time and resources for financial institutions.

9. Asset Management

AI is transforming asset management by providing more accurate and timely insights into market trends and investment opportunities. AI algorithms can analyze market data in real-time and identify investment opportunities that align with a firm’s investment strategy. This can result in higher returns and reduced risk for asset managers, ultimately benefiting their clients.

10. Real-Time Fraud Prevention

AI is being used to prevent fraud in real-time by analyzing transactions as they occur. AI algorithms can detect patterns that may indicate fraudulent activity and flag them for further investigation. This proactive approach to fraud prevention can help financial institutions protect themselves and their customers from financial losses.

11. Enhancing Customer Service

AI-powered chatbots and virtual assistants are transforming customer service in the financial industry. These AI systems can handle a wide range of customer inquiries and issues, providing instant responses and freeing up human agents to focus on more complex tasks. This improves the overall customer experience and reduces wait times for customers.

12. Improving Operational Efficiency

AI is helping financial institutions improve their operational efficiency by automating repetitive tasks and processes. This includes tasks such as data entry, document processing, and compliance checks. By automating these tasks, AI can reduce the risk of errors and free up employees to focus on more strategic activities, ultimately improving overall efficiency and productivity.

Conclusion

AI is revolutionizing financial forecasting by maximizing accuracy and providing valuable insights into market trends. From sentiment analysis to algorithmic trading, AI is helping financial institutions make more informed decisions and stay ahead of the curve. As AI continues to evolve, its impact on the financial industry is only expected to grow, further solidifying its status as a game-changer in the world of finance.