Navigating Finances Together: The Top Personal Finance Management Apps for Couples

In the journey of building a life together, managing finances as a couple can be both rewarding and challenging. The key to a successful financial partnership lies in effective communication, shared goals, and the right tools. In the age of technology, personal finance management apps have become indispensable for couples looking to navigate their financial journey seamlessly. In this article, we will explore some of the top personal finance management apps designed specifically for couples.

Honeydue: Bridging the Gap

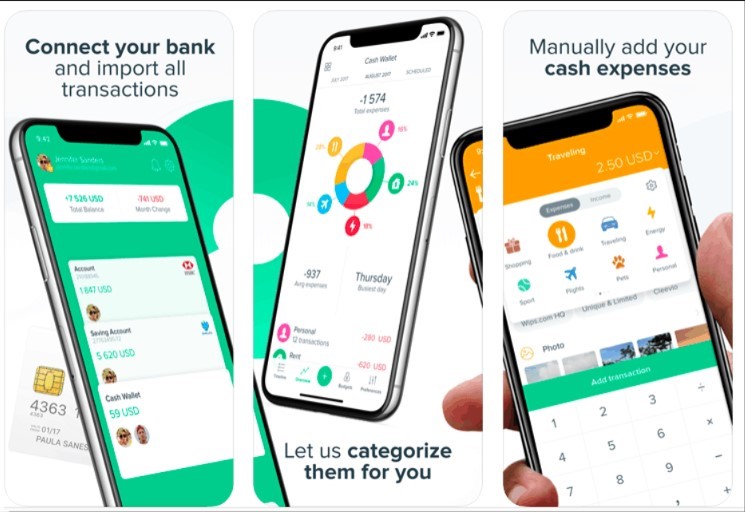

Honeydue is a user-friendly app designed to bring transparency and ease to managing finances as a couple. The app allows partners to link their accounts, providing a real-time overview of their combined financial landscape. One of Honeydue’s standout features is the ability to categorize expenses and set budget limits for various spending categories. This ensures that both partners are on the same page when it comes to financial goals and spending habits.

Moreover, Honeydue fosters communication through its in-app chat feature. Couples can discuss transactions, set financial goals, and track their progress together. This not only helps in maintaining financial accountability but also strengthens the bond by encouraging open conversations about money matters.

Zeta: Tailored for Couples

Zeta is an app that goes beyond just expense tracking, offering comprehensive tools specifically tailored for couples. The app enables joint account tracking, allowing partners to see both shared and individual transactions. Zeta also facilitates bill splitting, making it easier for couples to manage shared expenses seamlessly.

A unique feature of Zeta is the ability to set and track financial goals together. Whether it’s saving for a dream vacation or planning for a home purchase, Zeta provides a collaborative platform to monitor progress and celebrate milestones. The app also includes a shared calendar for couples to stay organized with upcoming bills and financial commitments.

Every Dollar: Budgeting Bliss for Couples

Built on the principle of zero-based budgeting, Every Dollar is an excellent choice for couples looking to take control of their finances collaboratively. The app allows couples to create a budget together, assigning every dollar a specific purpose. This approach ensures that both partners are actively involved in the budgeting process and have a clear understanding of where their money is going.

Every Dollar syncs across devices, enabling couples to stay updated in real-time. The app also provides insights into spending patterns and offers customizable reports, making it easier for couples to identify areas where they can save or adjust their budget. With Every Dollar, financial planning becomes a shared responsibility, fostering a sense of unity in managing finances.

Twine: Goal-Oriented Investing

Twine is a unique personal finance app that combines budgeting and investing for couples. It allows partners to set joint financial goals, such as saving for a vacation or a down payment on a home. Twine then creates a customized investment portfolio based on those goals, providing a tangible path towards financial success. The app emphasizes the importance of shared aspirations and financial planning.

Twine’s approach to goal-oriented investing sets it apart from traditional personal finance apps. By aligning investments with specific objectives, couples can work together towards achieving their dreams. This feature not only promotes financial growth but also strengthens the sense of partnership in achieving long-term goals.

Good budget: The Envelope System for Couples

Based on the age-old envelope budgeting system, Good budget brings a modern twist to personal finance management for couples. The app allows partners to allocate funds to virtual envelopes, representing different spending categories. This visual representation helps couples understand their budget at a glance, promoting better financial decision-making.

Good budget enables synchronization across multiple devices, making it easy for couples to stay connected with their budget on the go. The shared envelopes feature allows couples to collaborate on budgeting decisions, ensuring that both partners are actively involved in the financial planning process. By adopting the envelope system, couples can allocate funds wisely and avoid overspending in specific categories.

Split wise: Streamlining Shared Expenses

While not a traditional personal finance management app, Split wise plays a crucial role in managing shared expenses among couples. It simplifies the process of splitting bills, tracking IOUs, and settling debts between partners. This can be particularly helpful for couples who prefer to keep individual accounts but still want an organized way to manage shared expenses.

Split wise maintains a clear record of who owes what, eliminating potential misunderstandings and awkward conversations about money. The app supports multiple currencies, making it suitable for couples with diverse financial backgrounds. By streamlining shared expenses, Split wise contributes to a harmonious financial partnership without the need for complex calculations.

Conclusion:

Navigating personal finances as a couple requires a combination of communication, trust, and the right tools. Personal finance management apps designed for couples offer a convenient way to achieve financial harmony by providing shared visibility, collaborative budgeting, and streamlined expense tracking.

Whether it’s the transparency and communication features of Honeydue, the tailored tools of Zeta, the budgeting bliss of Every Dollar, the envelope system of Good budget, or the shared expense management of Split wise, these apps empower couples to take control of their financial journey together. Choosing the right app depends on the unique preferences and needs of each couple, but with the right tools at their disposal, couples can build a solid foundation for a financially secure and fulfilling life together.